2016 Toyota Highlander Crossover USA - The Highlander looks small and yet is set to be capable to accommodate up to eight passengers including its driver. The latest redesigned highlander is pleasant; bringing Toyota's nature, friendly fuel-consumption cost, acceptable styling and better marks in performance ratings. Let's see what the crossover has with 2016 generation to offer, see newest 2016 Toyota truck segment.

Pricing: Think real, it's impossible not to tweak the sticker. From $29,770 as showed on the current Highlander LE Standard model, Toyota adds a new tag for 2016 version with $29,995 - $225 more expensive.

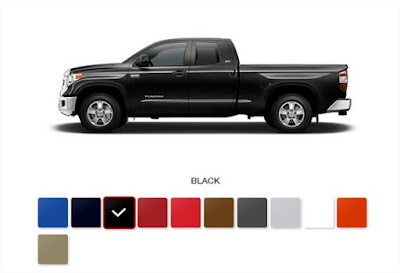

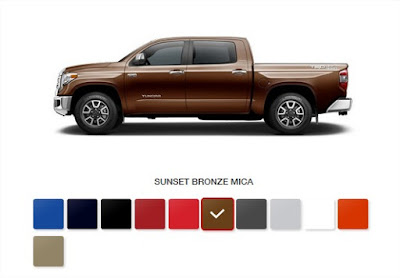

Exterior Colors: We didn't see another or more new ones, but that 9 options must keep going as usual.

Concept: The new highlander won't change its personality of being a preferential family carrier. Owner says "athletic", comes with practical grill but significantly differed from other Toyota's vehicles'. One pair of LED daylight running lamps act as snazzy cheek, and special Chromtec tech developed for aggressive roof rails as well as prestigious chrome wheels as its key swank. Adjustable cushion height practically adds more headroom when it's needed while makes passengers more easily in and out. A common thing but you might want to know; the seating pack features leather trimmer and can be configured in at least 8 different styles, for heated, ventilated seats you should opt for a Highlander Limited. Wider dash looks less elegant for some, the combination of wood trim and metallic accent present fair details. The easy-to-access USB ports give you a bit simplicity. An up-to-eight capacity is great, even more exciting to split 60/40 the 3rd row seat. The highlander also owns a make-silence ability utilizing advanced footer materials and acoustic-mode glass windshield to create quiter feel inside. An natural entertainment sunroof presents by Platinum feature set, while rear-seat passengers are allowed to enjoy digital amusements displayed from a 9-ich above-head screen.

Performance: The new 2016 Toyota Highlander will still be run by either 2.7L 4-cylinder with 6-speed automatic for the shake of 184 pound-feet and 185-horsepower output, or a bigger one 3.5L V6 comes with the same power distributor to bring better figures of 270-hp and 248 lb-ft. The smaller one has been rated and unchanged at 25/20-mpg hwy/city, whereas the V6 is 1mpg less efficient in the city driving. Highlander-ers may opt an AWD or FWD with the 3.5L engine, but front-wheel-drive-only system for the standard. Besides having fun journey, your Highlander is packed with a skill to be towing stuff up to 5000 pounds.

Safety equipment: If IIHS' award matters for you, the Highlander (also the hybrid model) have gained a TSPP (Top Safety Pick Plus) reward over its excellent performance in terms of driving security. That grade comes from a number of Toyota's advanced technologies such as traction control, electronic braking distribution & braking assist and vehicle stability control which are packed in the Star Safety System.

Competitors: Honda Pilot, Ford Explorer, Nissan Pathfinder, Toyota 4runner, Acura MDX crossover

2016 Models: The 2016 Highlander LE goes with standard 2.4L engine matched 6-speed automatic and the AWD/FWD V6 is optional. 2016 Highlander LE Plus, XLE and Limited are all based on the 270-hp, FWD-or-AWD tubrocharged V6, while 2016 Highlander Hybrid is configured in special AWD-i and ECVT systems applied to the 3.5-litter power producer.

Pricing: Think real, it's impossible not to tweak the sticker. From $29,770 as showed on the current Highlander LE Standard model, Toyota adds a new tag for 2016 version with $29,995 - $225 more expensive.

Exterior Colors: We didn't see another or more new ones, but that 9 options must keep going as usual.

|

| Exterior look of 2016 Toyota Highlander Crossover |

Concept: The new highlander won't change its personality of being a preferential family carrier. Owner says "athletic", comes with practical grill but significantly differed from other Toyota's vehicles'. One pair of LED daylight running lamps act as snazzy cheek, and special Chromtec tech developed for aggressive roof rails as well as prestigious chrome wheels as its key swank. Adjustable cushion height practically adds more headroom when it's needed while makes passengers more easily in and out. A common thing but you might want to know; the seating pack features leather trimmer and can be configured in at least 8 different styles, for heated, ventilated seats you should opt for a Highlander Limited. Wider dash looks less elegant for some, the combination of wood trim and metallic accent present fair details. The easy-to-access USB ports give you a bit simplicity. An up-to-eight capacity is great, even more exciting to split 60/40 the 3rd row seat. The highlander also owns a make-silence ability utilizing advanced footer materials and acoustic-mode glass windshield to create quiter feel inside. An natural entertainment sunroof presents by Platinum feature set, while rear-seat passengers are allowed to enjoy digital amusements displayed from a 9-ich above-head screen.

Performance: The new 2016 Toyota Highlander will still be run by either 2.7L 4-cylinder with 6-speed automatic for the shake of 184 pound-feet and 185-horsepower output, or a bigger one 3.5L V6 comes with the same power distributor to bring better figures of 270-hp and 248 lb-ft. The smaller one has been rated and unchanged at 25/20-mpg hwy/city, whereas the V6 is 1mpg less efficient in the city driving. Highlander-ers may opt an AWD or FWD with the 3.5L engine, but front-wheel-drive-only system for the standard. Besides having fun journey, your Highlander is packed with a skill to be towing stuff up to 5000 pounds.

|

| Tech-feature updates for 2016 Highlander USA |

Safety equipment: If IIHS' award matters for you, the Highlander (also the hybrid model) have gained a TSPP (Top Safety Pick Plus) reward over its excellent performance in terms of driving security. That grade comes from a number of Toyota's advanced technologies such as traction control, electronic braking distribution & braking assist and vehicle stability control which are packed in the Star Safety System.

Competitors: Honda Pilot, Ford Explorer, Nissan Pathfinder, Toyota 4runner, Acura MDX crossover

2016 Models: The 2016 Highlander LE goes with standard 2.4L engine matched 6-speed automatic and the AWD/FWD V6 is optional. 2016 Highlander LE Plus, XLE and Limited are all based on the 270-hp, FWD-or-AWD tubrocharged V6, while 2016 Highlander Hybrid is configured in special AWD-i and ECVT systems applied to the 3.5-litter power producer.